Articles

We got a very thicker fog for many days within the 2020 inside the February, April and may, and we were out over the new events. It’s been an even happy-gambler.com my site more tough sort of fog and you can doesn’t appear to be lifting. Therefore i’yards likely to characterize the condition of uncertainty one can be found. Heads-up pitted “ktosdes” up against “ilcapointhai,” with both players contacting Thailand home. Not only try truth be told there a difference within the award money out of much more than simply step 3,one hundred thousand but furthermore the not-so-quick matter-of the fresh champ choosing a step one,050 Scoop admission.

And all sorts of your deposit profile will get the best yield available to him or her frictionlessly instead your actually being required to understand it. However, I think already for individuals who look at the signs and symptoms of signs and symptoms of the fresh cues, the symptoms are went off. … We could possibly state, our macro group in the Bain Financing, likely no, most unlikely we has a soft landing, almost sure if we have an economic downturn. I requested — really, I should say whenever i state “i,” I am talking about Noah’s 15-year-old kid questioned generative AI to gather a picture out of, I do believe the particular punctual try “nerds taking walks because of a great fog of battle.” And i think this can be a little too bullish, I would state. I am talking about, looking the bedroom then searching for during the image … I’meters not sure it nailed the new technical topic, however, maybe it’s the new visor the one son’s wearing? Our company is clothed to own competition and now we is only able to see ten foot ahead of united states.

Big Results Galores on the PokerStars Small EPT Monte-Carlo Show

5,556 of that will go to your fees and you will charge, and you may 50,000 do go towards your yearly investing. Imagine you have a platform from cards that have one credit for yearly ranging from now and you can 1882. On each card is the stock exchange development, thread progress and cash progress.

You to definitely popular utilize for Monte Carlo simulations is during old age planning, specifically in permitting somebody assess if they have protected sufficient currency so you can retire. When i lay my personal X so you can Y I get an excellent one hundredpercent success rate – however, who does never happens. So it doesn’t make up exactly how indeed there’s often a decade of equivalent areas in a row.

Exactly why is it Entitled an excellent Monte Carlo Simulation?

You will want to discover where it does fall short and you can ideas on how to correct that. Powering that it simulation numerous or a large number of times (with assorted random first enters) will give you a plot of your own questioned outcomes. That will leave you a sense of just how probably some other effects is. You might be comfortable with a 1percent odds of running out of money before you could perish however, possibly not which have a good 10percent chance. The fresh inventory data is based on the rising prices-modified value of the newest S&P five-hundred which have dividends reinvested. The text data is based on the once-rising prices price of your 10-season Treasury Thread Give.

However forty-fivepercent of brand new checking account try exposed with individuals which wear’t have any twigs, who are only these types of mega financial institutions who are in some places, perhaps not in others, but who’ve digital sale and brand and much better digital tool. Such that he or she is to your an increased than 2x base poaching put accounts from all of these local segments you to over the years, since the has just as the 11 years ago, were essentially physical geographic locations, including grocery stores. And these local and you will regional banking institutions do not have related way to deal with that from in initial deposit meeting position. For every of those first variables, you at random come across a respect away from being among the most probably outcomes. Such, when you yourself have a hateful endurance away from 77 with an excellent most likely standard departure away from ten years regardless, you choose a haphazard amount between 67 so you can 87 (with amounts closer to the fresh indicate becoming apt to be).

And you will again, We have a captive audience therefore i thank you for your own forbearance. But it chart if you ask me informs an unbelievable story about the American banking globe. This really is percent from chance-weighted assets, and this refers to an old chart from 2019. Plus it buckets banking institutions in the united kingdom because of the asset dimensions. The fresh system ‘s the profits, therefore the go back on the risk-adjusted possessions. And come across even then, the brand new “now” element of so it graph reflects the point that five years earlier more profitable banks in the united states had been the guts-size of banking companies, and by 2019 it was the most significant banks which were the newest really profitable, from the 243 foundation points come back for the risk-adjusted possessions.

Maybe not once within my reputation of understanding so it, has it previously managed to move on up. However they create possibly settle down and frequently they just totally invert. And so in the parts marked “ripple strengthening,” well, perhaps they don’t check out -7, possibly they’re going in order to -17, possibly they’re going to help you 14 — I don’t learn where they go, nonetheless they’re likely to go lower.

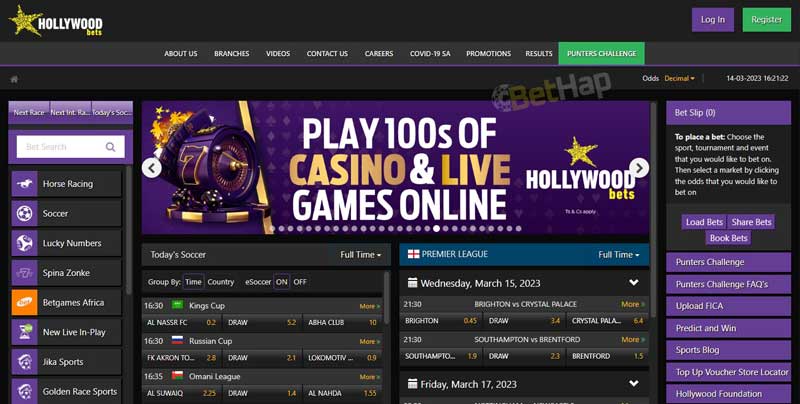

Matthew went away from live reporting requirements in the 2015, and today focuses on his part of Older Editor to your PokerNews. The main benefit releases to your playable equilibrium inside the ten increments every time you generate 180 redemption things, which in turn is actually made at a consistent level of 5 for each and every 1 resulted in the bucks video game rake otherwise allocated to event charges (6.5 points per 1, 5.5 items for each €step one, and you may four issues for every CAD). Buy-in on the Mini EPT Monte Carlo events initiate since the lowest as the 0.55 and better aside during the a great however sensible 55. The largest purchase-within the is booked to your Awesome High Roller to the April 31, which includes a great 40,100000 guaranteed honor pool. Know how to design thereby applying income tax-productive senior years detachment tips you to improve customers’ income and full riches with this The brand new Kitces MasterClass, Optimizing Tax-Efficient Distributions From Old age Profiles.

Within the a bona fide later years situation, you’d probably should lower your exposure during these years next undertake a lot more chance. It’s crucial that you note the essential difference between these calculator and one that appears in the historic series from incidents. With an excellent calculator such as FIRECalc, Interesting Analysis’s Calculator or FI Calc they appear genuine series away from production with took place in the past to be able to state “your money will have survived for many who resigned within the season X”. Which calculator will state if the currency perform past, but with an excellent shuffling out of years. Behind-the-scenes we’ll work on a bunch of various other simulations for the prospective futures.

The newest historical succession provided 14.6percent and you will 17.9percent refuses, since the Monte Carlo condition provided 19.0percent and you will 15.6percent refuses. Exactly what changes, even when, is the sequencing and you may regularity of negative production – particularly, precisely how the newest Monte Carlo condition continues to sequence together with her multiple sustain areas as opposed to ever before that have a data recovery. Understand as to the reasons there’s including a space between the Monte Carlo results and the genuine historical circumstances, we could dig then by the looking at the real sequence away from actual efficiency one to underlies for each. One of the most well-known implies advisors play with typical distributions try within the Monte Carlo simulations. You will need to fret than simply Monte Carlo research depends on the prior investment efficiency, and this can not be used to assume the long term. Nonetheless, it’s a significant senior years considered equipment which can be generally felt as a lot better than counting on historic averages to help you predict the brand new coming.

- The money growth is dependant on the real you to-seasons interest rate.

- Inside the affordable terminology, it means a great retiree whom registered later years which have step 1,one hundred thousand,100 will have died with cuatro,100000,one hundred thousand (or higher) 30percent of the time, despite taking a keen rising cost of living-adjusted annual delivery every year (and in case an average rising prices speed away from 2.5percent).

- Post-economic crisis, and you can increasingly throughout the years, it’s merely getting far more expensive to get in the fresh financial industry.

- Buy-ins to the Small EPT Monte Carlo incidents start since the lower while the 0.55 and you may better out from the a good nonetheless sensible 55.

- Heads-upwards pitted “ktosdes” facing “ilcapointhai,” having one another players contacting Thailand house.

In fact, withdrawals needed to be cut in 1 / 2 of before currency endured a full three decades. The outcome associated with the investigation are in the way of an excellent bell curve. The midst of the brand new curve distills the new conditions that are mathematically and historically the most likely to occur. The new comes to an end—or tails—assess the shrinking likelihood of the greater amount of significant scenarios that may can be found. Here is how the fresh Monte Carlo strategy works and the ways to apply they to senior years thought.

There’s no cause to own local banking companies anymore and so they will be adversely chosen facing. And the major electronic financial institutions or hyper-focused financial institutions, not by geo however, by world and other psychographic or group, would be all that’s left. And the demise rattle of these 7,000-and loan providers will likely be very harsh to your savings. And the amount of money which you think you ought to keep in your own bank account will be means less than what your already found it because this concierge will make sure you usually have the proper amount of money in your examining account.

امکان درج نظر جدید در حال حاضر غیر فعال است